This guide combines real-world experience with the actual SECURE 2.0 rules for 529-to-Roth IRA transfers. It’s written for people who want to do this correctly, avoid brokerage automation traps, and walk away with clean tax reporting and every dollar of bonus they’re entitled to.

This is not theory. This is how it actually plays out.

The Goal: What is a SECURE 2.0 529-to-Roth IRA Transfer?

- Transfer eligible 529 funds into a Roth IRA under SECURE 2.0

- Have the transfer reported as an annual Roth IRA contribution (not a rollover)

- Apply the contribution to the correct tax year

- Max out the Roth IRA contribution for that year

- Receive the full brokerage match (e.g., Robinhood Gold 3%)

- Ensure correct IRS reporting on Form 5498

Phase 1: IRS Rules for 529 to Roth IRA Rollovers (The 15-Year Rule)

Before moving any money, confirm all of the following. The IRS is strict here.

Eligibility Rules

- 15-Year Rule: The 529 plan must have been open for at least 15 years.

- 5-Year Rule: Contributions (and earnings) made in the last 5 years are not eligible.

- Lifetime Cap: Maximum of $35,000 per beneficiary over their lifetime.

- Annual Limit: The transfer counts toward the annual Roth IRA contribution limit (e.g., $7,500 for 2026).

- Earned Income: The beneficiary must have enough earned income for the year.

Important: A 529-to-Roth transfer is not a rollover under IRS rules. It is legally treated as an annual Roth IRA contribution.

Phase 2: Execution (The Paper-Trail Strategy)

Brokerage systems often default to treating mailed checks as workplace rollovers. Your job is to document everything so errors can be corrected quickly.

Step 1: Ask Support Before Sending Money

Contact support and ask:

- Where should a 529-to-Roth IRA transfer check be sent?

- Will it be treated as a current-year Roth IRA contribution?

- Will it be eligible for the full brokerage match?

Save the chat or email — even if an AI chatbot gives the instructions.

Step 2: Send the Check (Even If It’s a “Rollover” Address)

In real-world cases, support may instruct you to mail the check to a direct rollover PO Box. That does not automatically make it a rollover.

What matters:

- The source of the funds (a 529)

- The beneficiary matching the Roth IRA owner

- IRS rules governing classification

The brokerage can (and should) reclassify it correctly after review.

Step 3: Watch the Initial Posting — Don’t Panic

When the deposit first appears:

- The activity log may say “Rollover to Roth IRA”

- You may see only a partial match at first (e.g., 2%)

This does not mean it’s wrong yet.

Front-end labels are operational. Tax reporting fields are what matter.

Phase 3: Lock In the Classification (This Is the Critical Part)

You want explicit confirmation from support that:

- The funds are reported as a New IRA Contribution

- The correct tax year is applied

- The contribution maxes out the IRA for that year

- Any brokerage match is classified as interest/bonus, not a contribution

If needed, use this language:

“The IRS specifies that a 529-to-Roth IRA transfer must be treated and reported as an annual Roth IRA contribution. Please confirm this will be reported on Form 5498 accordingly.”

Phase 4: How to Get the Robinhood 3% IRA Match on 529 Transfers

If your brokerage offers a match (e.g., Robinhood Gold):

- Confirm your membership status is recognized

- Verify the full match percentage is applied

- Ensure the match is listed separately as interest or bonus

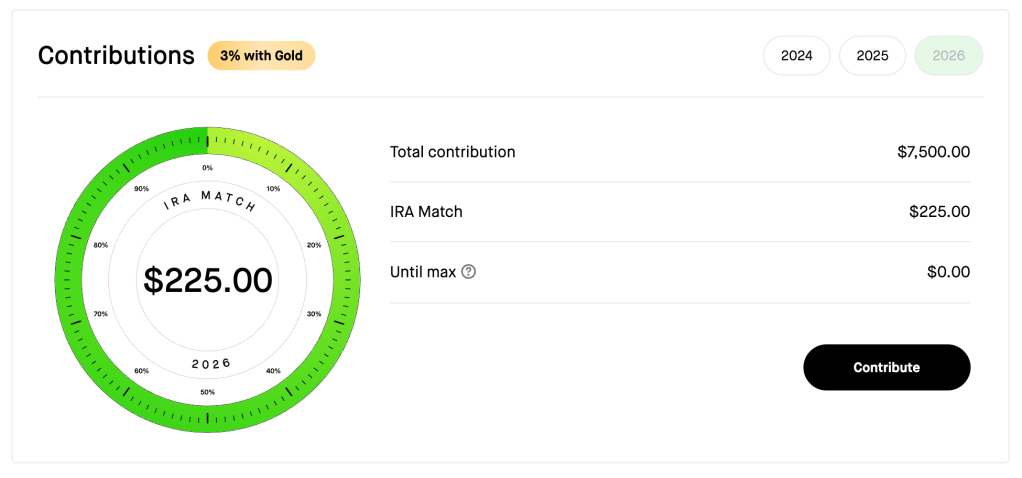

Example:

- $7,500 transfer × 3% = $225 match

If the system initially applies only part of the match, support can manually credit the remainder.

Recommend Tool: Try Robinhood Today and get your 3% Match!

Phase 5: Final Verification (Your Receipts)

Your account dashboard should show all three of the following:

| Item | Correct Status | Why It Matters |

|---|---|---|

| Contribution Type | New IRA Contribution | Ensures correct Form 5498 reporting |

| Tax Year | Current year (e.g., 2026) | Prevents rollover misclassification |

| Until Max | $0.00 | Confirms the IRA is fully maxed |

Additionally:

- Total contribution: Equals the annual limit

- Match: Listed separately and not included in the contribution total

If all of this is true, you’re done.

Common Gotchas (and Why They’re Not Fatal)

“It Says Rollover in the History”

This is a front-end label, not the tax classification. If the contribution type and tax year are correct, the IRS reporting will be correct.

“I Only Got 2% Match at First”

This usually means your premium status wasn’t detected immediately. Support can manually adjust it.

Final Checklist

- Confirm the source of funds is a 529 plan and that the beneficiary and Roth IRA owner are the same person

- Verify you meet all IRS requirements for a 529-to-Roth IRA transfer (account age, annual limits, lifetime limits, earned income)

- Make the check payable directly to the Roth IRA custodian (for benefit of the account holder)

- Do not label or describe the transfer as a “direct rollover from a workplace plan”

- Expect the transfer to be treated as an annual Roth IRA contribution, not a rollover

- Monitor your IRA contribution limits for the year to avoid over-contributing

- Check Form 5498 when issued to confirm it is reported as a Roth IRA contribution

- Save all confirmation emails, chat transcripts, and deposit receipts for your records

- If something looks off, contact support early and ask how it will be reported to the IRS, not just how it will be deposited

Final Notes

This process exists specifically to prevent unused education savings from being trapped or penalized. The intent of SECURE 2.0 is to allow eligible 529 funds to become tax-free retirement savings — but brokerage systems are still catching up.

Because of that gap, the most important skill here isn’t paperwork — it’s advocacy. Ask explicit questions, save every confirmation, and focus on how the transaction will be reported to the IRS, not just how it’s labeled in the app.

If you do that, this transfer is not risky — it’s one of the cleanest ways to repurpose unused 529 money.

Not Tax Advice

This guide is for educational and informational purposes only and is based on real-world experience combined with publicly available IRS guidance.

It is not tax, legal, or investment advice. Tax situations vary, and IRS rules can change or be interpreted differently depending on individual circumstances.

Before completing a 529-to-Roth IRA transfer, consider consulting a qualified tax professional or financial advisor to confirm how the rules apply to you specifically.

Author

Dylan Lepore is a multimedia professional, entrepreneur, and lifelong gamer who’s passionate about blending creativity with strategy. As the founder of LeporeMedia and The Part-Time Gamer, and the Business Manager at Port City Architecture, Dylan brings a unique mix of storytelling, design, and business savvy to everything he does. He lives in Portland, Maine with his fiancée.